Setups

Order Flow Made Easy

Setups

There are many ways you can use our indicator to find trades. We've listed our favourite setups below.

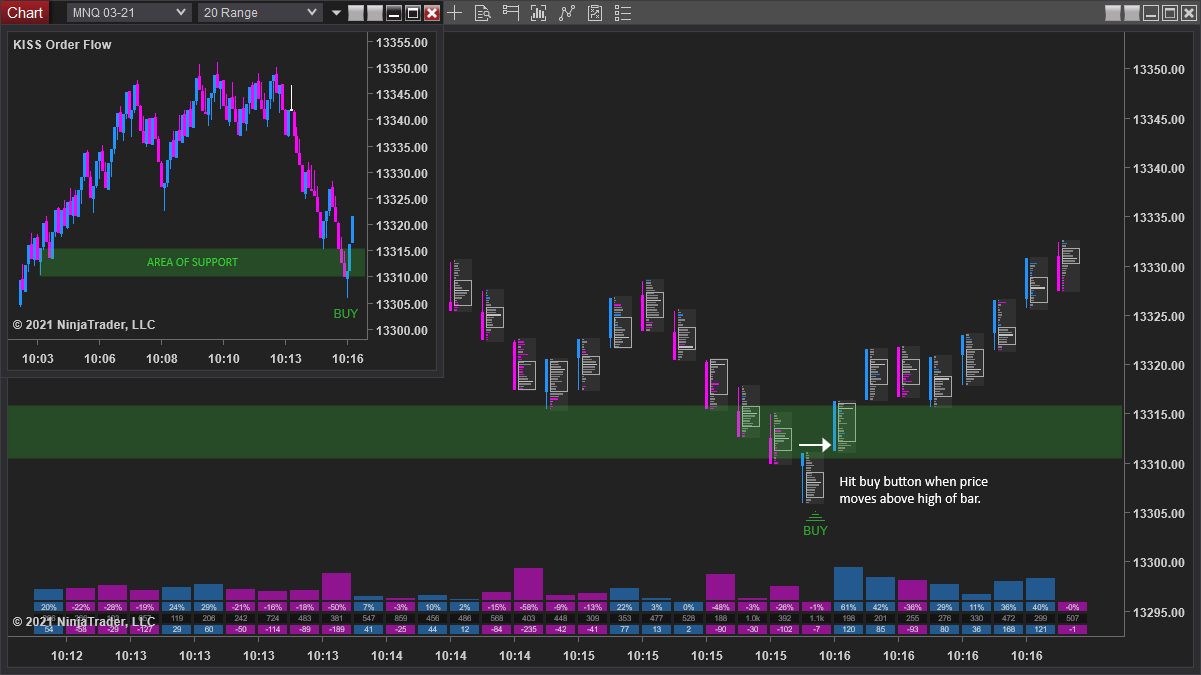

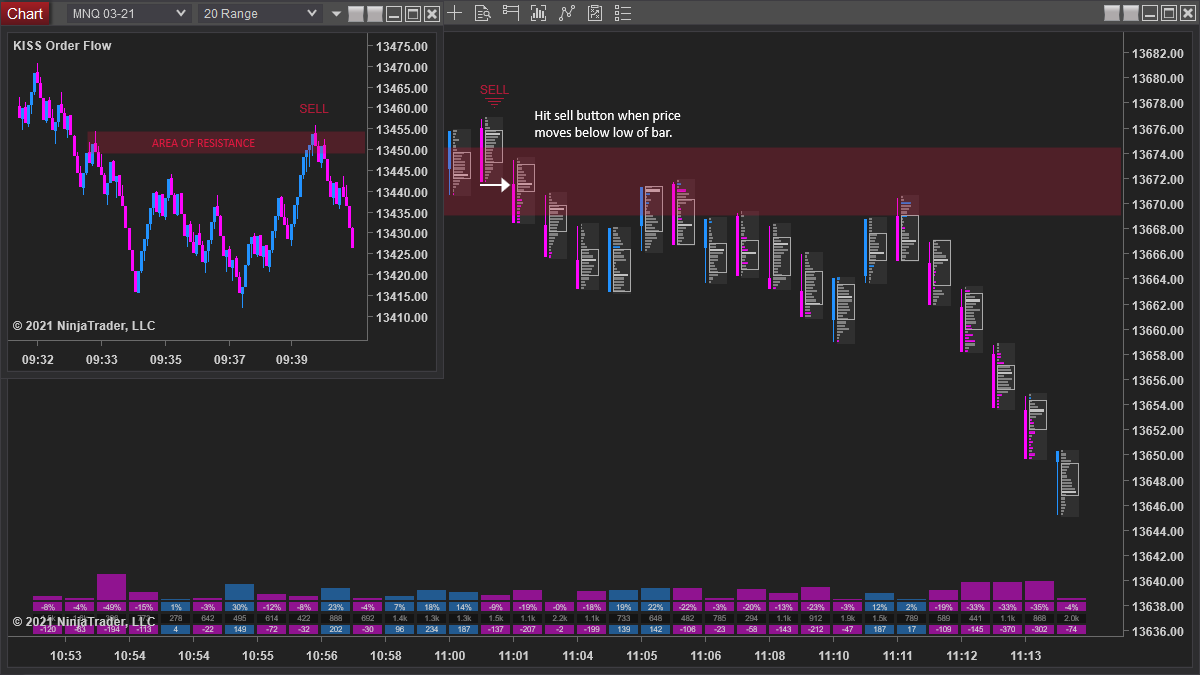

Trading the KISS Reversal Signals

Our signal is an order flow algo that detects potential reversals. Some of these signals also turn into tops and bottoms of big moves in the market. These signals are best traded with context. By far the easiest way is to trade the signals that come at areas of support or resistance.

The green and red bands have been manually drawn on the charts above.

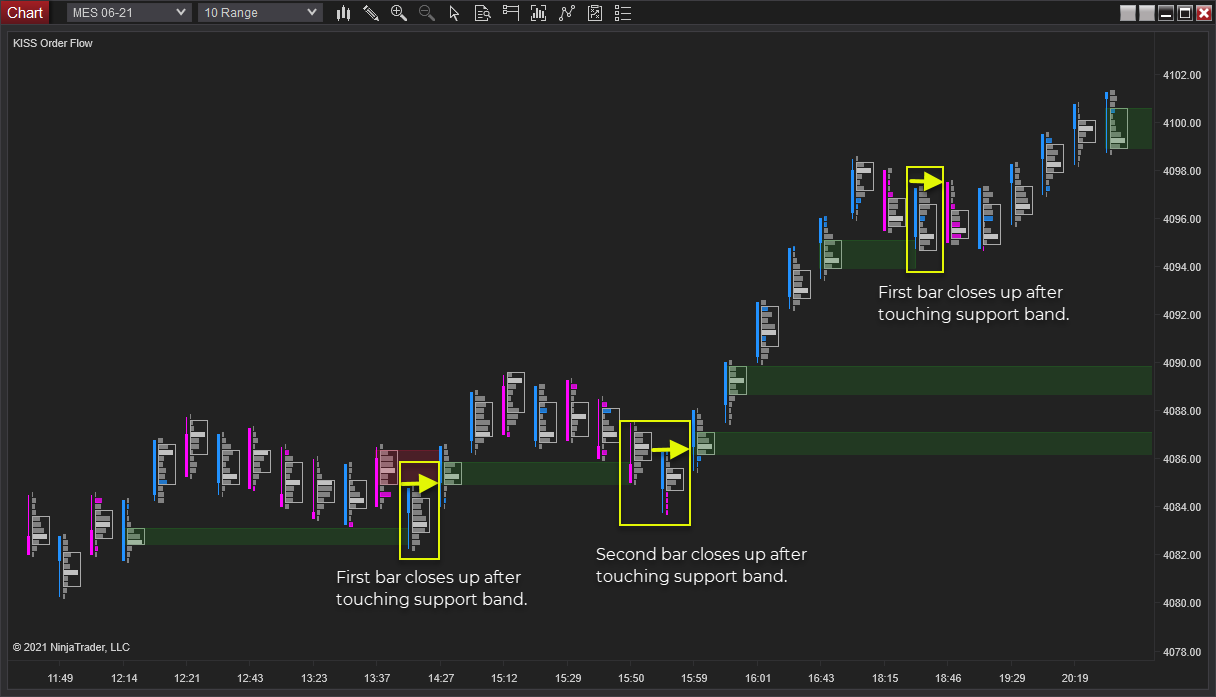

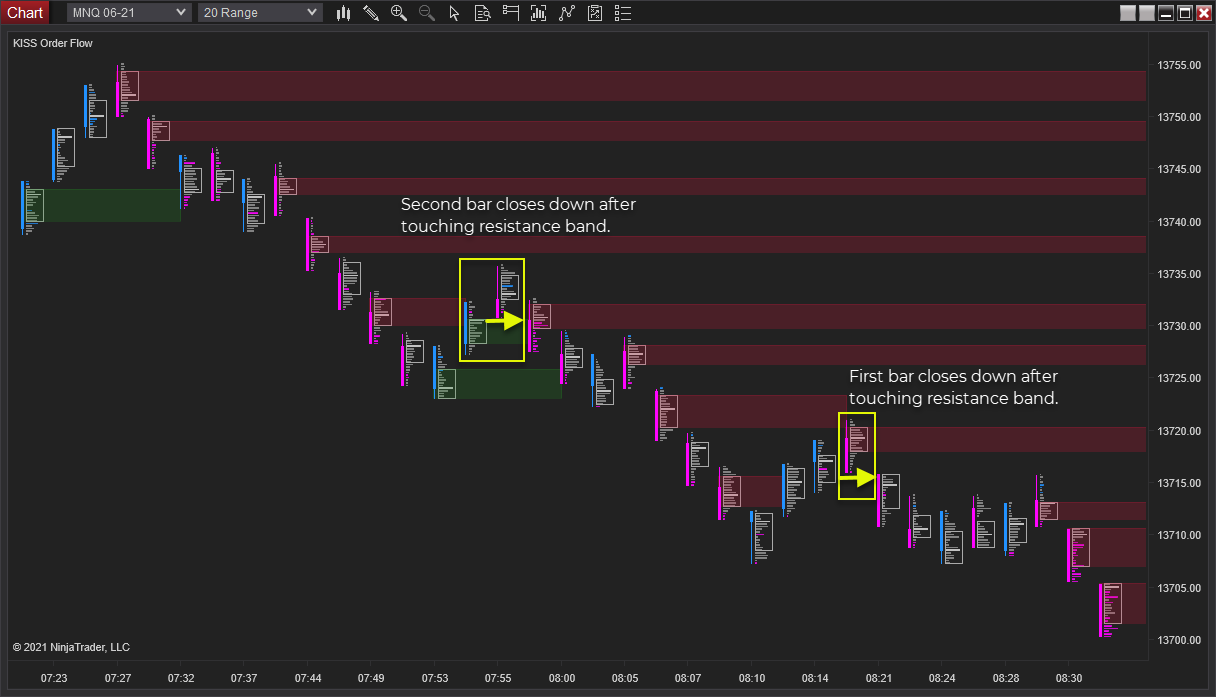

Trading the KISS Support & Resistance Bands

In version 2.1.10+ of our indicator, all areas of potential support and resistance are automatically drawn. These work straight out of the box with nothing to configure.

The setup we use to trade these occurs frequently, and is easy to spot:

- Wait for price to touch a green (support) or red (resistance) band

- If the first or second bar (after touching the band) closes in the opposite direction, enter!

As with any setup, no trade will work 100% of the time. It is important to wait for price to react at the area of potential support or resistance before taking the trade.

© 2025 KISS Order Flow. All Rights Reserved.

Financial Disclosure: Trading Futures, options on futures and retail off-exchange foreign currency transactions involves a substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations. No representation is being made that any account or indicator will or is likely to achieve profits or losses similar to those shown. There are sharp differences between hypothetical performance results and the actual results achieved by any particular trading program or indicator. Hypothetical trading does not involve any financial risk, and no hypothetical trading results can account for the impact of the financial risk of actual live trading. One of the limitations of hypothetical performance results is that they are often prepared with the benefit of hindsight. There are numerous other factors related to the markets in general. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown on this website. Past performance of indicators or methodology is not necessarily indicative of future results.